Posted by Melody on Friday, Mar 13, 2015

Those new to filing taxes as a sole-proprietorship business owner or as someone who is self-employed have a few forms and resources they need to become familiar with.

If you are starting from the very beginning, you can visit the Self-Employed Individuals Tax Center, an information resource provided by the IRS. The information in this blog post comes from there.

This web page links to the primary forms and publications needed. Pay attention to the following:

- 1040

- Pub 334 (Tax Guide for Small Business)

- Schedule C or Schedule EZ (Profit or Loss From Business)

- Schedule SE (self-employment tax)

This may not be an exhaustive list of the resources you need for your personal business purposes. If in doubt, contact a tax professional.

How to Search for Forms

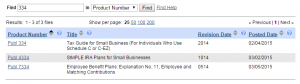

What is tricky is searching for these forms on the IRS’s Forms & Pubs page. You’ll need to know the right numbers or acronyms to bring up the correct downloadable PDFs.

From the preceding link, click on the “Find All Current Forms & Pubs” button.

The in the search box, try the following with the “Product Number” selected from the drop-down menu:

- 334

- Schedule C (Just “C” brings up way too much)

- Schedule SE

- SE

Searching by Title in the drop-down menu *sometimes* works, but again you have to choose the right words. “Profit or loss” works while “profit business” doesn’t. “Self-employment” brings up some good results, while “self-employed” may not get you to the right place.

The first web page I mentioned, the Self-Employed Individuals Tax Center, has a list of links on the upper right that may come in handy too.

If you need help finding other tax forms, feel free to contact us. We can help you print out the forms, too. Printing at the library is $0.10 per page black and white.

This is the second Katherine Center book I've read, and I think I like this one even more. While her first book was all about learning new wilderness skills and unpacking her emotional "backpack," The Rom-Commers took another forced situation trope and wrote a script with it. Emma is a fish-out-of-water kind of protagonist, having been plucked from her town and flown to L.A. to write with someone way more famous than her. Sound familiar? If you've read Curtis Sittenfeld's Romantic Comedy, which pairs a writer and musician and is also hysterically funny at times, you'll hear echoes of the plot setup and Hollywood setting. I feel like I laughed a bit more at Rom-Commers. Katherine Center is one of those romance writers that has mass appeal. Give me a good story, great characters, and a happy ending, and I'll fall in book-love. -Melody